Black Friday has long been heralded as the pinnacle sales event of the year for retailers across the country. However, behind the fanfare of blowout deals and crowded parking lots, this past Black Friday weekend revealed significant lost revenue opportunities for many merchants, according to a recent PYMNTS study. Despite record online sales of $9.8 billion, up 7.5% over 2022, gaps in technology led to an estimated $980 million left on the table from failed payments.

Specifically, the study found that nearly 1 in 10 online transactions (10%) failed over the last 12 months. With Black Friday online spending reaching new highs, these payment system deficiencies persisted, amounting to major lost revenues.

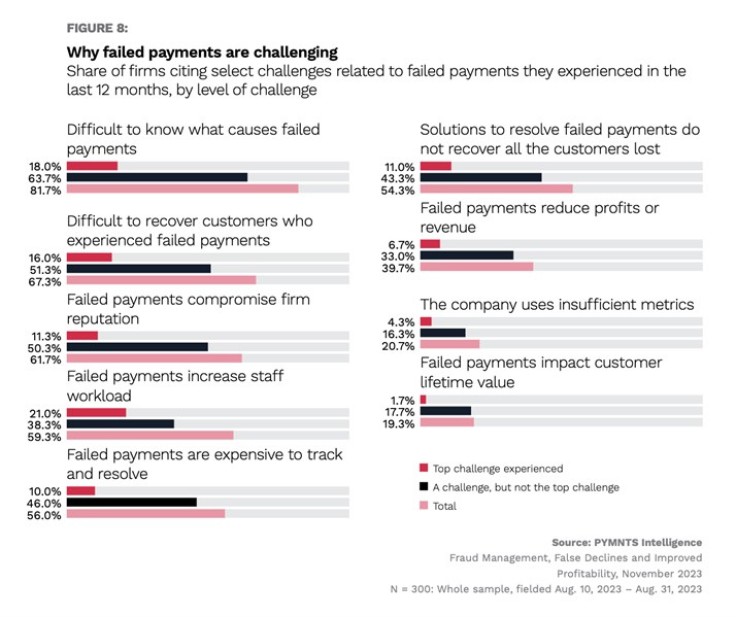

And the impacts of these failed payments extend far beyond direct lost dollars. Despite the pervasiveness, 82% of online merchants even struggle to identify the root causes of failed transactions in the first place. This could be due to a lack of understanding about payment gateway functionality.

For example, improperly configured payment gateways or inadequate testing of new gateways before launch could inadvertently set merchants up for higher decline rates. Other potential factors might include insufficient customer authentication during checkout, outdated fraud screening rules, or reliance on a single payment method without alternatives in place.

The fact that so many merchants are unable to conduct a root cause analysis makes recourse difficult. Further compounding the issue, 67% face challenges getting customers to complete a purchase after an initial failure, accelerating customer churn.

Financial Fallout Widespread from Failure Points

For international sales, in particular, which already see a 72% higher failure rate than domestic orders, the impact is even bigger. However, only one-third of businesses use fraud and error screening tools to minimize all these regular rejections for global customers. This means shoppers overseas likely face considerably more declined payments, directly cutting into profits.

And even when looking to bolster security and recovery tools, just 16% view recapturing lost profitability as a motivation. That oversight sees innovations falling short when it comes to the bottom line. Without a focus on driving financial upside, merchants miss opportunities to capture lost revenues from better prevention and recovery of failed payments.

This also takes a toll on retailer staffing. 59% of merchants report increasing workloads across employees simply to mediate failed payments. That pulls focus from customer service and sales efforts, dragging down productivity. Workers forced into more manual processes have less capacity for strategic tasks that would otherwise boost revenues.

The widespread ramifications of higher failure rates, especially internationally, combine with a lack of appropriate fraud tools and focus on recapturing revenue to limit financial outcomes directly. Meanwhile, the additional employee workload compounds the problem. When stretched resources align with muted financial upside prioritization, the missed revenue opportunities from failed payments only stand to increase.

Holiday Momentum Highlights Existing Gaps

And as holiday shopping momentum continues, those lost dollars and patrons can hamper returns. Tighter fraud parameters help curb risk, but drive declines. More personalized buyer verification balances security with experience yet adds overhead. Ultimately, the path forward requires identifying the weaknesses in existing failed payment prevention in order to reinforce a system prone to cracks as transaction volumes scale.

With transaction activity exponentially intensifying over peak periods, the gaps in fraud and failure prevention rapidly swell. Shortcomings that induce a 1-2 punch of missed sales and dissatisfied buyers do more damage than ever before amid the holiday crunch. It reveals the pressing need to build fungible systems that bolster consumer trust and merchant revenue year-round.

Because while holiday hype reliably fades come New Year's Eve, the savvy 21st-century shopper does not. Their preferences for seamless, secure purchases will only raise the revenue retention stakes for merchants in the seasons ahead. An acute focus must fall on the gaps festering beneath current failed payment approaches if retailers hope to sustain organizational success beyond the tinsel-trim returns of annual Black Friday blowouts.