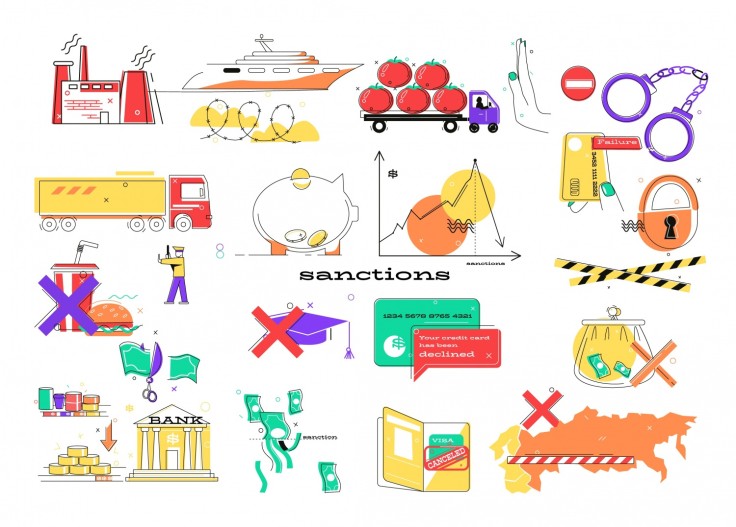

Trade sanctions play a key role in international relations. They are a means of influencing the countries against which they are directed.

Fintech expert Sergey Kondratenko notes that sanctions affect not only the target countries but also global trade, financial systems, and the geopolitical situation. Imposing sanctions on a particular jurisdiction automatically affects all economic entities related to that jurisdiction.

Sergey Kondratenko: The Concept of Trade Sanctions and Their Purpose

Trade sanctions are measures that include restrictions or penalties on international trade between countries. These measures can be in the form of import or export bans, embargoes, tariffs, quotas, or financial restrictions. According to Sergey Kondratenko, such measures are usually applied by one or several countries. The expert emphasises that trade sanctions play a primary role in exerting economic pressure on the states against which they are applied.

Usually, sanctions aim to influence these countries' behaviour by creating costs and limiting access to international markets, resources, and technologies. They are often used as a diplomatic tool to prevent undesirable actions, such as human rights violations, proliferation of nuclear weapons, financing of terrorism, or aggressive behaviour towards other countries.

The goals of trade sanctions are most often directed at the following tasks:

- Changing the policy or behaviour of the target country. Sanctions may be imposed to compel a state to change its domestic or foreign policy. An example might be an attempt to stop the proliferation of weapons of mass destruction or end human rights violations.

- Supporting international law and order. Sanctions are often applied as a means of enforcing compliance with international treaties and resolutions, such as United Nations Security Council resolutions.

- Strengthening internal security. Sometimes, sanctions aim to prevent military conflicts or threats to national security by restricting certain countries' access to important technologies or resources.

- Economic pressure. Sanctions may be used to weaken a country's economy to reduce its ability to support aggressive or undesirable political actions.

- Symbolic value. Often, sanctions carry a symbolic character, emphasising disapproval of certain actions or policies on the international stage.

Trade sanctions can be multilateral, supported by several countries or international organisations, or unilateral when one state imposes restrictions unilaterally. Multilateral sanctions are often considered more effective as they limit the target country's ability to find alternative sources of goods or services.

On the other hand, trade sanctions do not always achieve their goals and can have negative consequences not only for the target country but also for the states imposing them. Economic losses can be significant, and there can also be humanitarian problems if sanctions affect the population's supply of basic goods and services.

An important aspect is the legal justification for trade sanctions. They must comply with international law and be justified in terms of the international obligations of the imposing countries. For example, UN sanctions must be approved by Security Council resolutions.

Thus, trade sanctions remain one of the key tools of international politics, used to influence states in various situations, from military conflicts to economic and legal disputes. However, their application requires careful analysis of potential consequences and must be coordinated with international partners to achieve maximum effectiveness.

Sergey Kondratenko: The Impact of Sanctions on the Global Economy and Financial Markets

The expert states that limited access to international markets and financial systems can have a significant impact on a country's economic growth. Such a situation leads to difficulties in attracting investments and disrupting supply chains. Sergey Kondratenko emphasises that sanctions can increase the cost of imports, lead to a shortage of goods on the domestic market, cause inflation, and increase unemployment levels.

For example, economic sanctions that were imposed against Iran by the United States and other countries had a significant impact on Iran's economy. According to data from the International Monetary Fund (IMF), the growth rate of Iran's real GDP fell from 3.8% in 2017 to –6.8% in 2019, partly due to the effect of sanctions.

Financial sanctions, in turn, can restrict access to the global banking system, complicate cross-border transactions, and affect the stability of the global financial system.

"According to a report by the United Nations Conference on Trade and Development (UNCTAD), global direct foreign investment (FDI) flows to countries under sanctions decreased by 31% in 2019. This demonstrates the significant impact of sanctions on the structure of investments and international economic relations," explains Sergey Kondratenko.

The expert believes that assessing the effectiveness of trade sanctions is a complex task. In some cases, they may lead to achieving the desired results; however, their success depends on several factors:

- the stability of the target country,

- the type and scale of sanctions,

- the global economic situation,

- support from other countries.

Therefore, before imposing sanctions, it is necessary to carefully assess their potential consequences and balance international interests and policy goals.

Circumvention of Sanctions and Punishment from the EU: Tactics and Advice for Business from Sergey Kondratenko

In a world where political vectors are quite dynamic and can suddenly change direction, businesses must manoeuvre.

The first and most important thing, according to the fintech expert, is to be aware of all laws and regulatory acts that pertain to international trade. All entrepreneurial activities must be strictly within the law.

Additionally, it is necessary to reduce risks associated with possible trade disruptions due to sanctions. Diversity in supply chains and establishing relationships with partners from different countries become important strategic steps. It is also essential always to be prepared to respond to potential problems. Creating reserve stocks of goods and searching for alternative markets for product sales can help minimise the damage from sanctions.

If we talk about EU member states, circumventing sanctions for them is an offence.

In March 2024, the European Parliament adopted new rules on punishment for violating and circumventing sanctions. As Sergey Kondratenko said, violations of sanctions include such actions as:

- Refusal to freeze the assets of sanction targets.

- Violating travel bans.

- Transferring funds to sanctioned individuals.

- Conducting business with state companies from countries under sanctions.

The European Commission's report noted that violation and circumvention of sanctions would be classified as criminal offences for which imprisonment for up to five years will be prescribed. Additionally, penal sanctions will be applied.

Sergey Kondratenko: The Role of the Fintech Industry in Complying with Sanctions and Counteracting Violations

For successful development in the FinTech sector, it is not only necessary to strive for innovation but also to strictly comply with regulatory requirements, believes Sergey Kondratenko.

By the beginning of 2023, the financial technology market was valued at $179 billion USD and is expected to reach $376 billion USD by 2026. Compliance with regulatory requirements plays a key role in the successful development of this sector.

For effective operation and avoidance of violating international sanctions, fintech companies need to implement comprehensive risk management systems. This includes using advanced technologies for monitoring financial operations, regularly updating databases of sanction lists, and training employees. Companies must also actively collaborate with regulators and monitor changes in legislation to adapt to new requirements and minimise legal risks promptly.

The expert particularly emphasises that non-compliance with requirements can seriously affect the financial condition and reputation of a company.

Sergey Kondratenko stresses that compliance with requirements for the FinTech industry is becoming increasingly complex:

- Hypergrowth of FinTech. The level of consumer use of FinTech products has significantly increased, making compliance even more critically important and complex.

- Technological compliance. FinTech companies must integrate compliance procedures into their technological solutions, creating a safe environment and effective risk management. And the abnormally high growth of users makes this process complex and costly.

- Adaptation to regulatory changes. Regulators actively intervene in the FinTech sector, establishing new rules and guidelines. Therefore, it is necessary to maintain a large staff of consultants, study, and quickly integrate any changes. At the same time, compliance helps companies adapt to these changes and avoid fines for violations.

Sergey Kondratenko believes that compliance in the FinTech sector leads to the minimisation of risks and fines. Such a stance by companies strengthens customer trust, contributing to long-term success and business growth.