Bibit - a known robo-advisor application mainly based and operating in Indonesia has been reported to secure funding with a total amount of 30 million USD from world renowned venture capital Sequoia Capital India.

The funding dubbed as a growth round was filled with various investors such as East Ventures, EV Growth, AC Ventures, and other 500 startup companies. It comes along after the Series A funding for Bibit in 2019. The latest funding round would then bring up the company's current funds for a total of 45 million USD. This was told by the Chief Executive Officer (CEO) of the company himself, Sigit Kouwagam to known tech website TechCrunch.

Bibit's Brief History

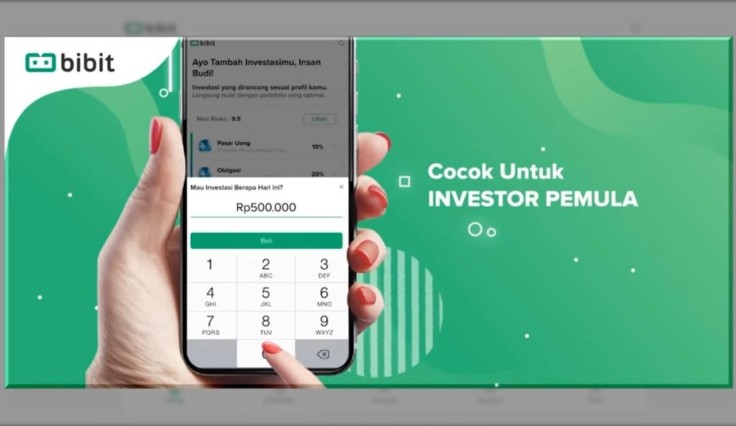

The app was first launched in Indonesia last 2019 by the Stockbit Group. It then became a platform for various investors in which they could share news and updates, as well as real-time investment strategies where others can utilize those. At about ninety percent of the app's users are labeled as millennials and first-time investors.

Bibit's goal for its users is inclined on making it easier for them to develop and create their very own portfolio which could be specified depending on every person's indicated profile, as well as their investment goals being listed.

Also Read: Tesla Gigafactory Texas Construction Video Posted in YouTube

The app now currently holds an already established mutual funds selling agent license in which it is within the reach of the supervision of the financial services authority of the country itself, as shared through a statement.

The company's claim shows that they have already registered more than one million first-time investors on to their app over the last year. Data which comes from the Indonesian Stock Exchange and the Indonesia Central Securities Depository has shown that there was a particular rise and growth regarding the number of the retail investors in the country which has seen a development of 56 percent at a year-over-year rate during 2020.

On top of that, the data also lists that about 92 percent of the new investors are classified to be in the age of 21 to 40 years old. Yet even despite this huge sum of improvement for the company and the industry of investments in Indonesia, only about 2 percent of the whole amount of investors that participated are Indonesians.

Bibit on Indonesians

The CEO himself told TechCrunch that most of the Indonesians are fonder of investing their money in a term deposit bank accounts setup. Another option for them would be leaving their own money on low yield checking accounts. Yet the company tends to further widen its reach and capacity along with the new funding round deal which they have closed and secured a sure sum of amount for the overall continuity of their operations which may see potential and possible expansions in other countries in the future.

East Ventures managing partner and co-founder Wilson Cuaca mentioned that both Stockbit and BIbit "have been positively impacted during the pandemic." He also added that they have a fast-growing number of retail investors that has seen a then tenfold growth in transactions during the last year, according to Kr-Asia.