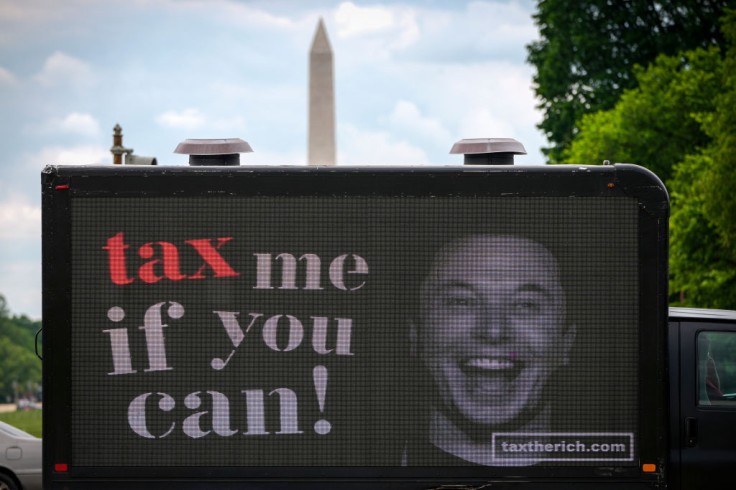

Leaked information regarding the taxes of some of the wealthiest Americans, including Elon Musk, has surfaced online. ProPublica's report earlier on Tuesday showed just how much the 25 richest Americans paid in tax.

The U.S. government is now investigating how their tax information got leaked to the public, Business Insider reported. The sensitive, private, and confidential nature of the leaked information have the Internal Revenue Service and the Treasury assuring the public that the matter is being taken care of.

Despite raising the issue of tax information leaks as a violation of privacy, ProPublica insisted that it is of public interest to know such information. The tax system can clearly be gamed and, given the figures,be systemically unfair.

Even U.S. Senator Bernie Sanders and former Secretary of Labor Robert Reich took to Twitter to express their sentiments of taxing the rich after the leak.

True tax rates of billionaires:

— Bernie Sanders (@BernieSanders) June 8, 2021

Warren Buffett: 0.10%

Jeff Bezos: 0.98%

Michael Bloomberg: 1.30%

Elon Musk: 3.27%

Tax rate for working class Americans: 24.2%

Tax the billionaires. Make them pay their fair share. Rebuild our nation's crumbling infrastructure. https://t.co/MVtYO8w63O

The White House has made a statement that the Biden administration is taking the illegal leak of tax information very seriously, also noting how corporations and individuals of the highest income will be ensured to pay more of their fair share as part of Joe Biden's budget and proposals, Business Insider added.

Elon Musk Tax Leak

In the list of 25 wealthy individuals reported by ProPublica, Tesla CEO Elon Musk is included. For what it's worth, he is the the second-richest person in the world.

Musk's wealth grew close to $14 billion from 2014 to 2018, the ProPublica report claimed. His reported income was at $1.52 billion. However, he has only paid $455 million in taxes.

In 2015, he paid $68,000 in federal income tax. In 2017, he paid $65,000. In 2018, the report has found that Musk paid no federal income taxes.

That comes up to about 3.27 percent as Musk's true tax rate, or a percentage of his total wealth growth.

Elon Musk's Response on Twitter

While the other individuals on the list have their lawyers and representatives give out statements or have kept silent, Musk took to Twitter to address the concerns and his thoughts as well.

According to Teslarati, Tesla's rise in stock price over the past year is being accounted for Musk's "increase in wealth" and not by a paid salary from his employer.

Teslarati pointed out that Musk hasn't accepted salary from Tesla, and his stock isn't taxable unless he sells it due to the Capital Gains Tax, which are only paid when profit is realized on those stocks.

Twitter users who support Musk have also shared their opinion, backing the billionaire and the federal tax system.

Musk has shared and agreed with multiple Twitter users and shed more light to how his finances are in actuality.

Yeah, sold my houses, except for 1 in Bay Area that’s rented out for events.

— Elon Musk (@elonmusk) June 9, 2021

Working on sustainable energy for Earth with Tesla & protecting future of consciousness by making life multiplanetary with SpaceX. Also, AI risk mitigation with Neuralink & fixing traffic with Boring.

Outlined in his contract, according to Teslarati, Musk receives performance-based incentives. He collects those when the EV company reaches thresholds for deliveries, profitability, or other metric that proves the CEO is assisting or complementing the company's growth.

These are paid in stock options and constitute his wealth but not his realized income. Unless sold, those stocks are not to be taxed like the salary he is legally required to collect, "I don't cash it. it ends up accumulating in a Tesla bank account somewhere," as Musk told The New York Times.

Exactly. Only time I sell Tesla stock is when my stock options are expiring & I have no choice.

— Elon Musk (@elonmusk) June 9, 2021

Btw, I will continue to pay income taxes in California proportionate to my time in state, which is & will be significant.

The figures of wealth, income, and taxes of the richest individuals and corporations have become a topic of debate for the longest time. This has also become the fuel of a lot of political campaigns for either party, or against the tax system of the government.