Apple has something new for its Apple Card users.

The Cupertino-based tech giant recently announced that Apple Card users can now grow their Daily Cash rewards with a Savings account from Goldman Sachs, allowing them to get more with the feature.

Apple launched its Apple Card service in 2019 to "help customers lead a healthier financial life," per the company's statement. It offers customers a familiar experience with Apple Pay and the ability to manage their cards right on their devices.

Apple Card Savings Account Details

Apple mentioned in its announcement that Apple Card users in the US can open a savings account and earn interest starting Apr. 17 without paying any fees, giving no minimum deposits, and maintaining a minimum balance.

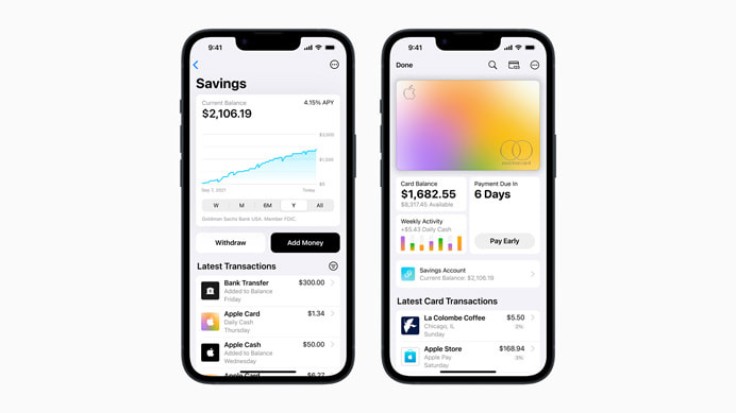

The savings account, which comes from Goldman Sachs, an investment banking company, offers a high-yield annual percentage yield (APY) of 4.15% - a rate more than ten times the national average. However, Apple does state in its footnotes that the APY may change at any time and that its 4.15% APY was true as of Apr. 14.

Additionally, the company stated that the average APY could change at any time, with the national average APY for savings accounts being at 0.24% around the time Apple launched its new savings account feature, per Bank Rate.

Nevertheless, Jennifer Bailey, Apple's vice president of Apple Pay and Apple Wallet, stated that Appel's goal in launching this new feature is to "build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly - all from one place."

"Savings helps our users get even more value out of their favorite Apple Card benefit - Daily Cash - while providing them with an easy way to save money every day," Bailey said.

How Apple Card's Savings Account Works

Users shouldn't have to worry about their money going into their savings accounts as they're technically managed by Goldman Sachs, meaning that their balances are covered by the Federal Deposit Insurance Corporation, per Tech Crunch.

Once an Apple Card user opens a savings account, all of the Daily Cash they earned will automatically go into the account, though they could change its destination at any time, and there's no limit on how much they can earn at a time.

To better capitalize on their savings accounts, users could even deposit additional funds into them through a linked bank account or from their Apple Cash balance. They will also have easy access to an easy-to-use Savings dashboard in Apple Wallet, allowing them to track their account balance and interest earned over time.

Interestingly, users who open a Savings account can withdraw and transfer funds from it to a linked bank account or to their Apple Cash card without paying any fees. However, users may want to keep a lookout on their balance as it cannot exceed the maximum limit of $250,000.

Related Article : Apple to Use 100% Recycled Metals for Its Components by 2025